Resilience as a Competitive Advantage

How investors are finding alpha in adaptation

Physical climate risk is influencing cost of capital

- Recent Bloomberg research found that “Markets appear to be pricing physical climate risk into the cost of capital for firms… firms with higher physical risk exposure (+10 percentage points in asset damage rate) face a +22bps premium in their Weighted Average Cost of Capital (WACC), even after accounting for sector, region and size.”

- The penalty is strongest in asset-heavy sectors such as materials and utilities, and in emerging markets like Latin America and Asia, but markets are not applying a blanket “country risk premium.” They are differentiating between firms within countries, meaning climate resilience has started to function as a financial differentiator.

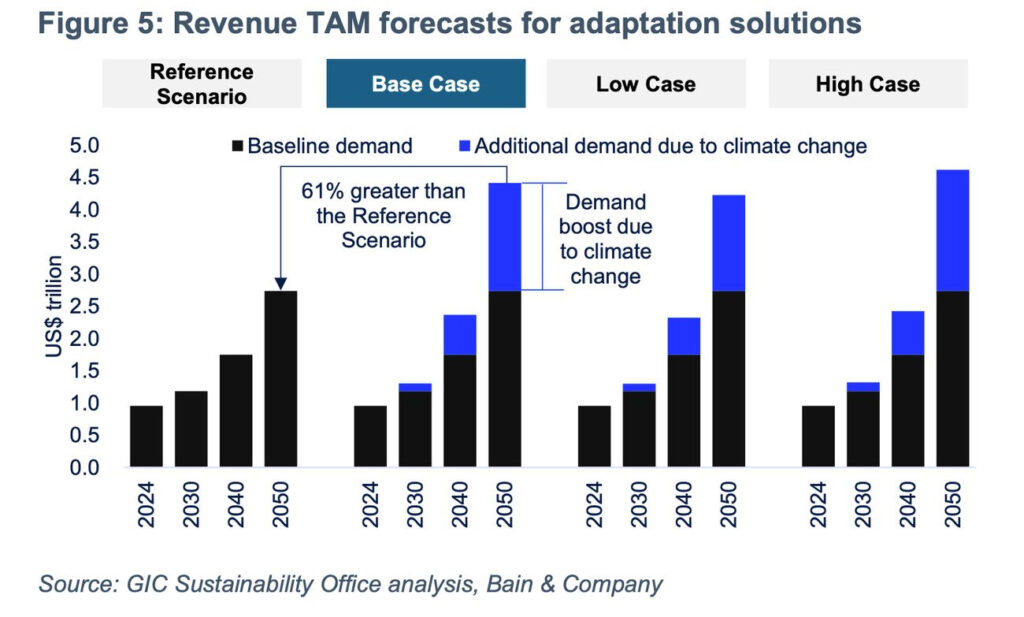

Climate adaptation solutions to exceed revenue projections based on historical trends by 61% – GIC & Bain

- According to GIC and Bain’s report: Sizing the Inevitable Investment Opportunity, global revenues from a select set of climate adaptation solutions are expected to grow from US$1 trillion (tn) today to $4tn by 2050. Of this, GIC estimates $2tn will be incremental revenue growth driven by global warming.

- The corresponding investment opportunity set across public and private debt and equity is expected to increase from US$2tn today to US$9tn by 2050, with US$3tn representing an incremental increase attributable to global warming.

- When factoring in revenue drivers attributable to increased global warming, GIC expects the 2050 revenues of climate adaptation solutions to exceed projections based on historical trends by 61 percent. According to GIC, “Most financial planning & analysis (FPA) teams and sell-side analysts continue to rely on historical data for forecasting. This information gap creates a unique opportunity for long-term investors to invest in a space where company earnings may positively surprise as demand for climate adaptation solutions grows.”

The Prepare and Repair Index already outperforms

- This ‘climate surprise’ alpha is already at play. When hurricanes Helene and Milton hit, Lowe’s Chief Financial Officer Brandon Sink told investors that storm-related demand “drove better-than-expected results,” boosting fourth-quarter sales.

- Broadly, Bloomberg found that disaster-related spending in the United States has surged to nearly 1 trillion dollars in the past year, up from around 80 billion in the 1990s. Bloomberg’s Prepare and Repair Index, which tracks about 100 large companies involved in climate adaptation and recovery, outperformed the S&P 500 by 6.5 percent per year from 2015 to 2025.

Join us in Tokyo!

Join us in Tokyo on November 18 for a roundtable discussion on Climate Adaptation & Resilience: The Next Frontier for Investors, co-hosted by Tailwind Futures, Environmental Energy Investment and 0 Club (Mitsubishi Estate).

Emilie Mazzacurati will participate in a fireside chat with Tomomi Ishida of Environmental Energy Investment, followed by a startup showcase with QFF (Quantum Flowers & Foods), a biotechnology startup using neutron breeding for rapid biological climate adaptation. The event will then transition into an open roundtable discussion on venture investment opportunities in climate adaptation and resilience.

Fellowships, Accelerators and Prizes

- Applications for Breakthrough Energy Fellows Cohort 6 are open until Nov 10. This is a great opportunity for founders thinking about next steps in early-stage funding and commercialization support.

- If you need more time, the Fellows team has offered an extended window for Tailwind’s referred applicants through November 24; just shoot them an email.

- The program focuses on technologies that have the potential, at scale, to reduce or capture greenhouse gases by at least 500 million tons per year or technologies that meaningfully address adaptation to climate change.

- This prestigious Fellowship program is a full-time, one-year commitment for innovators committed to commercializing their climate technology. Typically, Innovator projects have raised less than $2M in dilutive funding.

- The program offers up to $500,000 in catalytic, early-stageinvestment (e.g. SAFE, Convertible Note) and $500k of in-kind resources, technical expertise, an extensive network, and critical commercialization support.

- The Scale For ClimateTech Cohort 7 applications are open until November 14.

- Scale For ClimateTech provides growth-stage innovators with the resources, connections, and access to funding to refine their prototype into a design that’s easy to manufacture and mass produce.

- Halcyon’s Climate Resilience & Food Security in Africa Fellowship is live!

- This fellowship will serve founders across Africa who are building sustainable solutions in climate adaptation and resilience and food security.

- Benefits include tailored business training, access to Halcyon’s global, impact-driven network, $10K in Amazon Web Services, Inc. (AWS) cloud computing credits, $6K stipend per venture, Two one-week, in-person residencies

- Share with your network and apply by November 20th!

Tailwind Futures Updates

Recent Events

The Tailwind Futures team has been active across California this month, contributing to a series of leading events on impact investing, climate resilience, and innovation.

- Emilie Mazzacurati and Osama Idrees were at SOCAP25, one of the world’s largest convenings of the global impact ecosystem happening October 27-29 in downtown San Francisco.

- Emilie moderated the Founder Showcase: Women Entrepreneurs Driving Change hosted by the Cartier Women’s Initiative.

- TDK Ventures hosted its invite-only 100X event on October 21-23 in San Francisco.

- Emilie spoke Thursday, October 23rd on the panel “The Rise of Climate Adaptation and Carbon Removal.”

- Osama Idrees spoke at the World Economic Forum’s Urban Transformation Summit October 23 in San Francisco.

- Osama was a panelist on “Built for Disaster: Cities for a Hotter, Riskier Future” and participated in the Executive Roundtable: Unlocking the Resilience Dividend on Thursday 10/23.

- Tailwind Futures chaired the Sustainable Brands Adaptation and Resilience Summit at SB ‘25 in San Diego.

- Emilie gave a macro-view of climate risk and resilience to open the summit.

Upcoming Events

- Nov 6: ULI Fall Meeting – San Francisco, CA

- Nov 18: Climate Adaptation and Resilience: the Next Frontier for Investors – Tokyo, Japan

- Tailwind Futures is co-hosting a roundtable discussion

- Dec 2-3: MaRS Climate Impact – Toronto, Canada

- Brooke Zhang will represent Tailwind Futures at this annual event hosted by MaRS

- Dec 3: Cleantech Spark: Tokyo – Tokyo, Japan

- Frank Freitas will represent Tailwind Futures at this invitation-only event.

- Dec 8: Symposium on the Design, Construction, and Operation of Energy-Efficient Buildings – Berkeley, CA

Did someone forward you this email? Sign up for Tailwind Futures’ newsletter here!

Pitch us! If you’re a startup founder or operator, learn more about our investment thesis and fill out this form to start a conversation.