Tailwind Futures Monthly Newsletter

Market Insights

Droughts in key copper-mining regions are increasing due to climate change, threatening the already-strained copper supply. At the same time, demand for copper is surging, driven by skyrocketing demand for datacenters to support AI models, a real estate and construction sector that uses more copper than ever before in the built environment, and an energy sector reliant on copper to support grid expansions and increasing renewable energy generation. This presents both a challenge for corporations reliant on a stable copper supply, and an opportunity for investors to back tomorrow’s solutions.

In the absence of interventions, PwC sees far reaching implications including “32% of the projected US$1 trillion semiconductor supply [being] at risk within a decade unless industry adapts to climate change.”

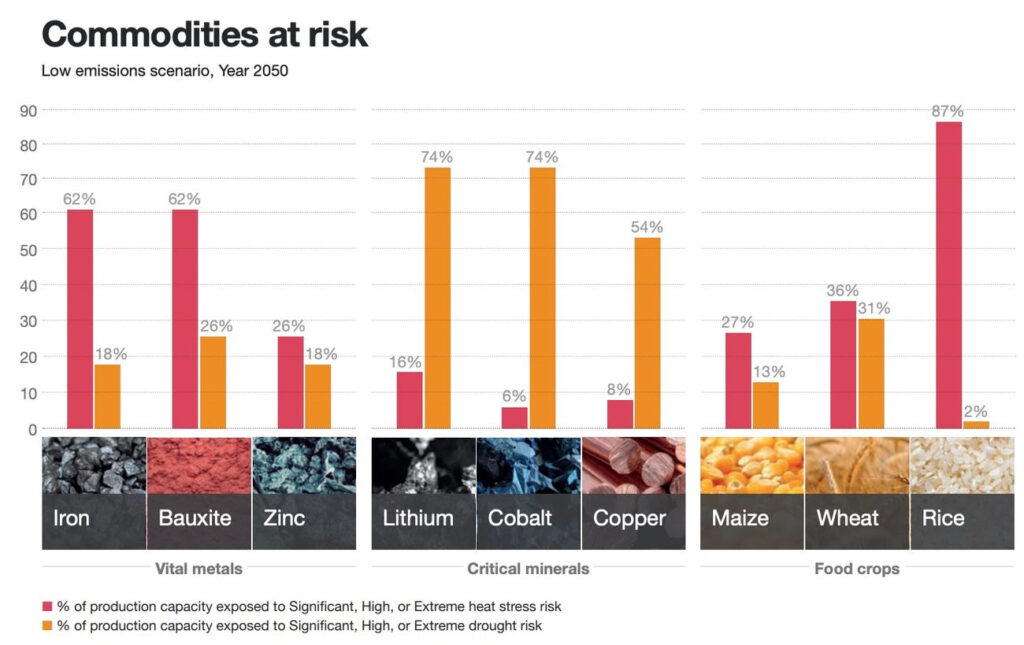

Copper is only one of several key commodities at risk from climate change.

Source: PwC, Climate Risk to Nine Commodities, 2024

PwC estimates that under an optimistic, low-emissions scenario, 54% of copperproduction will face either significant, high, or extreme drought risk by 2050. Under a high emissions scenario, this rises to 77% of total copper production, 20% of which is at “extreme risk” of water supply shortages.

Mining corporations recognize the risk water supply presents to their core operations and are quietly preparing for a drier future. Teck Resources Limited, a Canadian mining company says “we cannot mine without the use of water.” To adapt to the harsh and increasing water scarcity in Chile’s Atacama desert where major copper deposits are found, Teck Resources built a seawater desalination plant and pumps water 4,400 vertical meters (14,400 ft) to the site. Mine-level water conservation and procurement methods are increasingly being adopted but they are not enough alone to alleviate the pressures on copper supply.

According to the International Energy Agency, existing mines and projects under construction will meet only 80% of copper needs by 2030, and this analysis does not appear to account for climate-induced water stress projections. Outside of water stress, limiting factors on copper supply include globally declining ore grades, permitting challenges and community opposition, inflation reducing the incentive for capital intensive projects, and rising geopolitical and logistics risks.

Globally, the majority of copper ore is concentrated in only a handful of locations, fueling the commodity’s climate and geopolitical vulnerability. Over half of all copper production occurs in Chile, Peru, and China collectively, with 30% coming from just 8 mines. Over half of copper processing occurs in China alone. This exposes copper-dependent industries to supply chain risks such as tariffs, geopolitical tensions, and regional events that have the potential to become globally-cascading logistics disruptions.

As droughts intensify and logistics challenges increase, securing a future-proof coppersupply is an imperative for corporations across building construction, datacenters, renewable energy, computer hardware, and other critical industries. Technological solutions can mean the difference between price spikes and procurement problems, or a reliable supply chain and competitive edge in the marketplace.

This presents a challenge, but also an opportunity for the innovative startups addressing different aspects of the problem. Potential solutions include for example predictive analytics that provide real-time identification and prediction of supply chain disruptions, and the development of new materials as copper substitutes.

At Tailwind, we are tracking the most promising innovations to help corporations futureproof their infrastructure, workforce, and supply chain, particularly by building resilience to the impacts of a more chaotic climate and weather system. Addressing critical commodity supply chain risks is a theme where we see a growing opportunity for solutions that leverage the latest advances in AI, predictive intelligence, and materials science.

Tailwind Updates

Recent Events

Tailwind was in San Fransisco on July 15 for the Global Adaptation and Resilience Investment (GARI) group private roundtable and reception event, Climate Adaptation Investment: Exploring the $1T Opportunity.

We heard from leading adaptation and resilience investors The Lightsmith Group and the Autodesk Foundation, dove into the recently released report “The Private Equity Opportunity in Climate Adaptation and Resilience” with BCG, and heard how The Climate Policy initiative sees the “$1T Opportunity for Climate Adaptation Investment.”

Attendees also had a chance to zoom in on specific innovations with entrepreneurs from AiDash, BurnBot, and Sofar, as well as insights on demand from California Forward.

Fellowships, Accelerators and Prizes

- Last call for two water-tech resilience programs!

- New York City is seeking startup applicants for a water tech pilot program. Apply here by August 8th!

- Uplink is looking for innovative solutions to enable water resilience across infrastructure, agri-food, tech and energy systems. Ten winners will receive an even share of CHF 1.75 million financial award. Applications are due August 4th!

- The Tara for Women Call for Entrepreneurship is out!

- The initiative is aimed at women with a transformative vision, social commitment and provides support for disruptive technology-based projects across biotechnology, technologies for civil safety and resilience, and technologies for sustainable development.

- Successful applicants receive a 6-month mentorship program, visibility & strategic positioning showcasing your project, financial awards, and 20 finalists will receive professional video pitch support and global exposure opportunities.

- Apply by September 1st.

- Klarna’s AI for Climate Resilience Program is offering grants of up to $300,000 for projects that leverage AI for climate adaptation in underserved, climate-vulnerable regions, particularly in low and middle-income countries.

- Projects must demonstrate a clear use case for AI, a pathway to local ownership, and a commitment to responsible, collaborative innovation. Early-stage ideas are welcome.

- The deadline for proposals is August 31. Apply here!

Upcoming Events

- Sept. 21-28: New York Climate Week – The Climate Policy Initiative, Global Adaptation & Resilience Investment Working Group (GARI), Resilience Investments, Tailwind, and The Resiliency Company are collaborating to make adaptation and resilience the center of New York Climate Week.

- Is your organization planning an event focused on adaptation and resilience? Do you have new research or work you want to highlight? Do you want to host events focused on enhancing resilience in the face of extreme weather changes? Let us know here:https://lnkd.in/ei-GJXyp

- More details on our calendar of events coming soon!

- Oct 13: Sustainable Brands – San Diego

- Oct 14-15: Adapt Unbound Europe – Amsterdam

- Oct 21-23: WEF Urban Transformation Summit – San Francisco

- Oct 23 – TDK Energy Futures – San Francisco

- Oct 27-29: SOCAP – San Francisco

- Oct 28-30: VERGE – San Jose

Did someone forward you this email? Sign up for Tailwind’s newsletter here!

If you’re a startup founder interested in connecting, please fill out this form.