Market Insights

Bloomberg Intelligence found that US Spending on Climate Damage Nears $1 Trillion Per Year.

- The United States spent nearly $1 trillion on climate-related disaster recovery and adaptation between May 1, 2024 and May 1, 2025, approximately 3% of GDP.

- A few major climate disasters made up a substantial portion of the total. Hurricanes Helene and Milton totaled $113 billion, while the January Los Angeles wildfires added $65 billion in costs.

- Disaster-related spending has risen to $18.5 trillion globally since 2000. The biggest drivers of this trend in the US are insurance premiums which have doubled since 2017, post-disaster repair spending, and federal aid.

- Increased climate costs from insurance premiums, power outages, disaster recovery and uninsured damages are responsible for $7.7 trillion, or 36%, of US GDP growth since 2000.

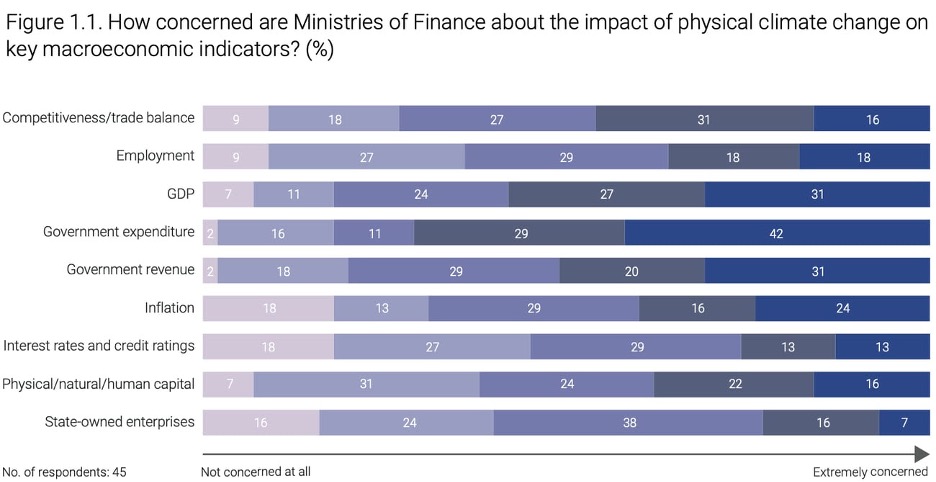

These rising costs are increasingly recognized by Finance Ministers as a major concern for the economy, found a Global Survey of Ministries of Finance conducted by the Coalition of Finance Ministers for Climate Action.

- Ministries of Finance (MoFs) are particularly concerned about the potential impacts of physical climate change on GDP and government finances and, to a lesser extent, inflation, employment, and competitiveness. 71% of respondents expressed high to very high concern for the impact on expenditure, and 58% shared the same levels of concern about GDP.

- These concerns are not yet translating into action, as only a quarter of respondents have conducted analysis of financing needs for adaptation and very few integrate physical climate risk considerations into their core analytics functions like tax and fiscal policy or macroeconomic forecasting.

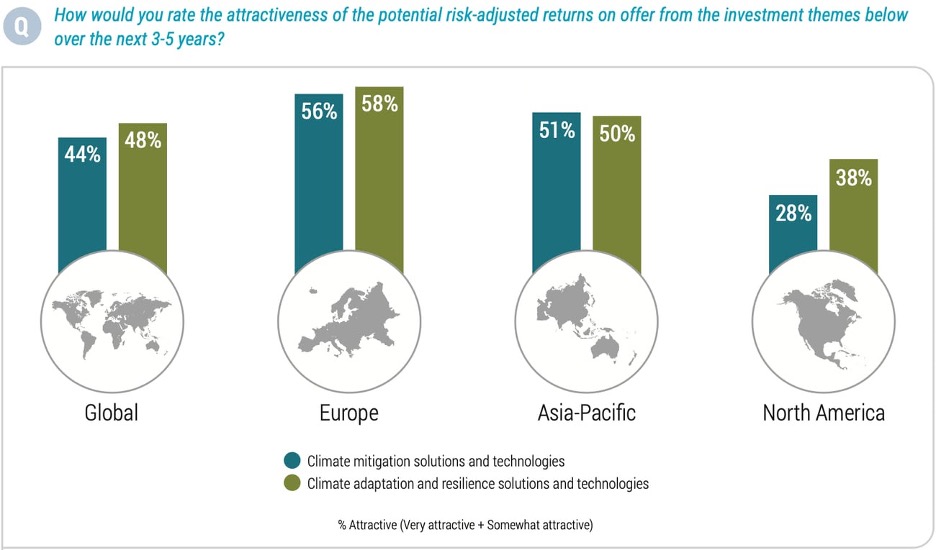

Investors, however, are seeing that climate risk is going to drive demand for adaptation and resilience solutions. Global asset manager Robeco released its 5th annual Global Climate Investing Survey this month:

- For the first time, investors see adaptation and resilience solutions as a more attractive investment than mitigation solutions.

- This could be due to what Robeco calls a “growing awareness of the necessity of climate adaptation” driven by an increasingly pessimistic outlook on an orderly transition to net-zero.

- This newfound interest in adaptation and resilience investments is yet to translate into actual investments – CPI’s Global Landscape of Climate Finance 2025 found adaptation finance (pure play + dual benefit) makes up less than 7% of global climate finance based on 2023 data.

- But Robeco also found that 46% of investors say climate change is at the center of or a significant factor in their investment policy – a 25% drop from last year, likely a consequence of political headwinds in the United States.

Tailwind Updates

Recent Events

At London Climate Action Week, Tailwind co-hosted the climate adaptation technology showcase & reception with Mazarine Climate. The event introduced startups tackling climate challenges from extreme heat to supply chain disruption and wildfire prediction. Our portfolio company Cryogenx presented, and shared their “ice bath in a backpack” solution for heatstroke. Check out Louie Woodall’s post for a recap of the event!

Team Updates

We’re welcoming a new team member this month – Carson Mayo – who joined us as an Analyst after completing his undergraduate education at UC San Diego. During his time at UCSD, Carson studied international economics and climate change science and guided outdoor adventures. He recently wrapped up his degree with summa cum laude and Phi Beta Kappa honors and is joining us after backpacking for two months through Central Asia.

Fellowships, Accelerators and Prizes

- MassChallenge is now accepting applications for their Security & Resiliency Accelerator.

- The US Early Stage Security & Resiliency Program is a zero-equity support program that supports early-stage startups solving critical challenges across energy, logistics & supply chains, infrastructure, bluetech, emergency response, and beyond.

- Apply here! Applications are open now through July 15th. The accelerator will run from September to November 2025 with hybrid programming based in Boston.

- The South Florida Risk + Resilience Tech Hub announced the launch of a Sustainable and Resilient Infrastructure Seminar Series.

- The first session will be led by Adam Friedman of 1Print, a concrete 3D printing solution. Adam will talk about lessons learned in coastal and housing resilience applications and future markets. To attend, email suranenip@miami.edu for the zoom link and stay tuned for a monthly series!

- Leading Cities announced the Top 100 Resilience Solutions and the members of their QBE AcceliCITY Resilience Challenge cohort.

- The Los Angeles Cleantech Incubator (LACI) is hosting an innovation competition for resilient rebuilding and climate action.

- Finalists will pitch their solutions July 23rd from 3-7pm at the La Kretz Innovation Campus for a chance to win up to $100,000 in prizes.

- Register here to watch the competition!

Upcoming Events

- Sept. 21-28: New York Climate Week – The Climate Policy Initiative, Global Adaptation & Resilience Investment Working Group (GARI), Resilience Investments, Tailwind, and The Resiliency Company are collaborating to make adaptation and resilience the center of New York Climate Week.

- Is your organization planning an event focused on adaptation and resilience? Do you have new research or work you want to highlight? Do you want to host events focused on enhancing resilience in the face of extreme weather changes? Let us know here:https://lnkd.in/ei-GJXyp

- More details on our calendar of events coming soon!

- Oct 13: Sustainable Brands – San Diego

- Oct 14-15: Adapt Unbound Europe – Amsterdam

- Oct 21-23: WEF Urban Transformation Summit – San Francisco

- Oct 27-29: SOCAP – San Francisco

- Oct 28-30: VERGE – San Jose

Did someone forward you this email? Sign up for Tailwind’s newsletter here!

If you’re a startup founder interested in connecting, please fill out this form.

Update your address book! Our website URL has changed to www.tailwindfutures.com. Team emails are also changing to reflect the new address and next month the newsletter will come from emilie@tailwindfutures.com.